AFIR: How to set up a scalable and compliant payment infrastructure for charging networks

With already more than 550,000 stations across Europe, the number of electric charging stations is growing rapidly. As almost half of all stations are in the Benelux countries and Germany, it’s clear that there’s a lot of work to be done in the EU. A new regulation for the deployment of Alternative Fuels Infrastructure (AFIR) aims to boost the number of publicly accessible electric recharging stations in Europe and also urges creating a more user-friendly recharging experience. However, this also entails some challenging obligations for charging point operators. An important one being payments.

AFIR and payments

The AFIR regulation ensures that payment at all electric vehicle charging stations in Europe will be uniform and simplified. For instance, from 2024, all charging points must be accessible without a subscription or pre-registration and enable contactless payments with credit and debit cards. Drivers of electric vehicles should be able to profit from the same payment options they’re used to at petrol stations.

Achieving this is easier said than done. The owners of the charging stations can be charging networks that only supply the infrastructure, but can also be energy companies. On the other hand, there are organizations that use this infrastructure to offer the charging experience. This could be either large stores with charging stations in their parking lots, or even municipalities. At the end of the day, the owner of the infrastructure is responsible for payments at the charging stations; he must enable consumers to pay easily with a debit/credit card or QR code and make sure that all beneficiaries receive their rightful share.

Owners of stations can’t act as a payment provider

An important barrier to doing this independently is the European PSD2 regulation. According to this regulation, they can’t act as a payment service provider without the required licence. Also, the owner of the infrastructure is not allowed to use an escrow account to set up a payment flow between the beneficiaries. Moreover, correctly doing this while it’s not your core business can be a big hurdle. To comply with PSD2, deliver a smooth consumer experience, and not have to worry about any scalability issues, owners of the charging infrastructure could consider cooperating with a specialized platform payment service provider (platform PSP).

In short: you are not allowed to receive, hold and/or split third party funds if you don't have a Payment Licence

Working with a payment provider will automatically ensure:

- PSD2 compliance as the platform PSP already has the required licence

- Onboarding of new merchants in the network by Know your Customer (KYC)

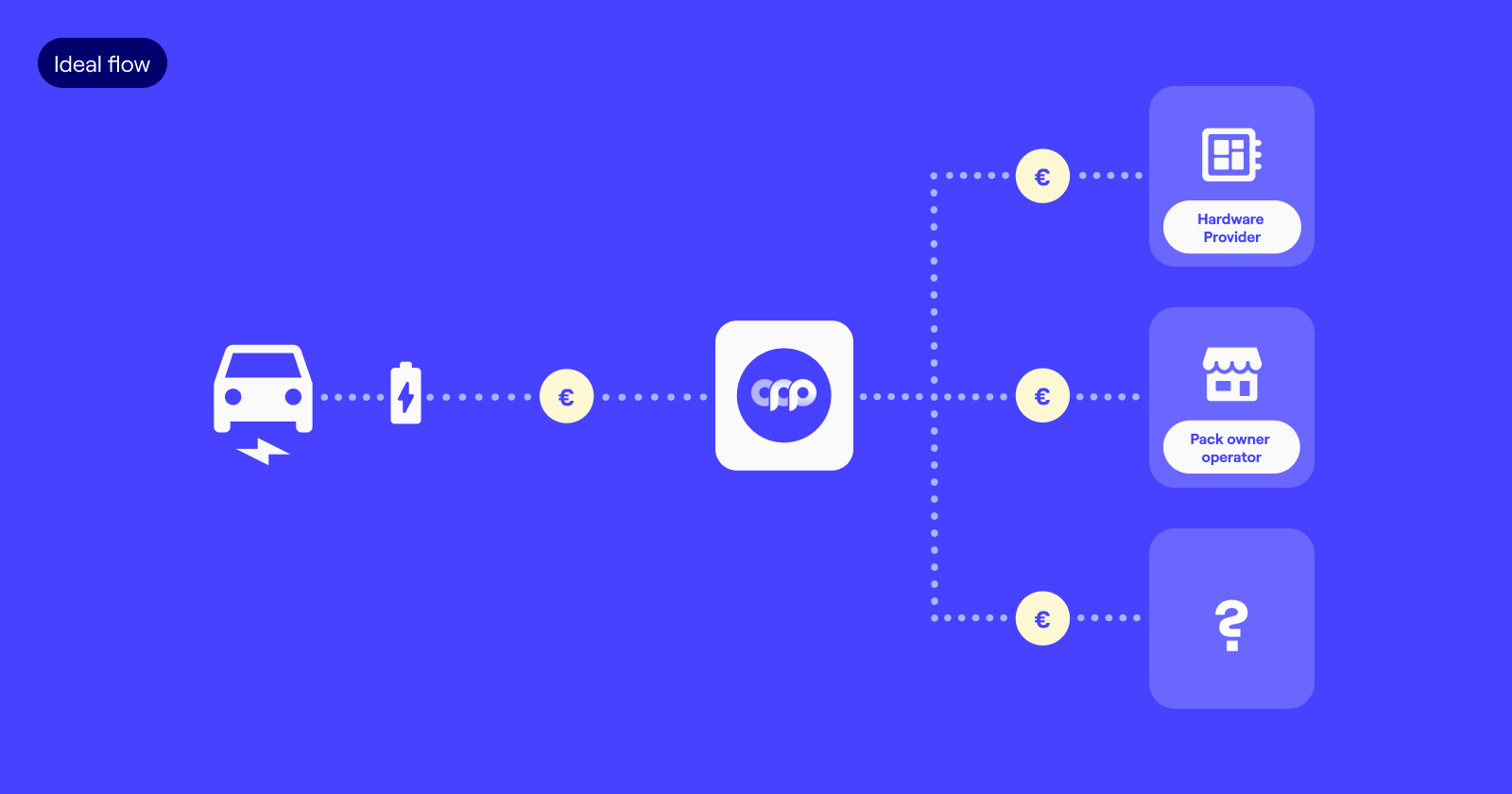

- Multi-split payments: the payment will automatically be split into compensation for all parties involved at the time of the transaction.

- Up-to-date connections with payment methods and easy expansion to other countries.

.svg)

.svg)

.svg)

.svg)

%20(1).png?width=1300&name=Copy%20of%20Copy%20of%20Blog%20post%20(1620%20x%201080%20px)%20(1).png)

.png)

.png?width=75&height=51&name=Worldline%20(2).png)