Petbnb first with C2C iDEAL payments

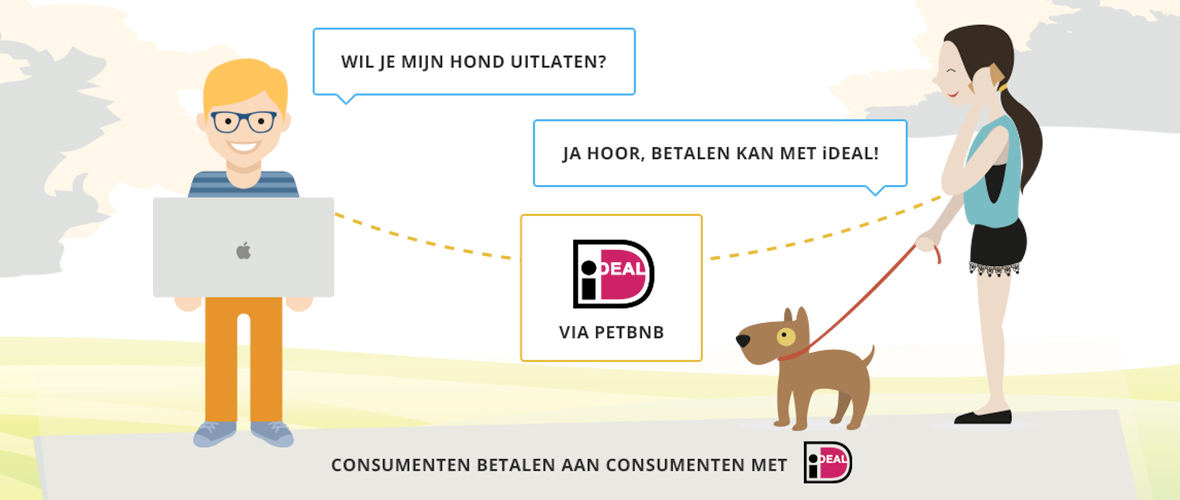

The first iDEAL consumer-to-consumer payments are a fact. Petbnb and Online Payment Platform are the first. This is the first time that the so-called “safe and legal” C2C payments took place in the Netherlands with iDEAL.

With thousands of individual dog sitters spread over the Netherlands, the time had come for Petbnb to lift online payments between sitters and owners to a higher level.

Online Payment Platform offers a new specialized solution to ensure reliable payments between consumers. Think about verification of buyers, holding funds in escrow until products are correctly delivered and automated revenue sharing between platform and seller.

Lupo Westerhuis – Founder of Petbnb:

“With the solution of Online Payment Platform, we are able to fully focus on offering trustworthy and skilled dog sitters on our platform. It took us a lot of time to enable the payments ourself. Besides that, it brings along many risks. The integration with Online Payment Platform enables us to verify the identity of sitters. Additionally, the dog sitters' money is safely secured on a third party account before the job has been paid out. We currently have enough time left to further develop Petbnb. Hence, it's the ideal online payment solution for us.”

Online Payment Platform responds to the growing demand to facilitate iDEAL and other payment methods among consumers.

Richard Straver – founder of Online Payment Platform:

“We are living in the platform economy. Examples are: Airbnb, Ticketswap and Thuisbezorgd. (Takeaway) These are all online places where supply and demand for a specific target group are brought together. We designed specific toolsets to solve the challenges associated with facilitating payments seamlessly. Paying directly on the platform increases the conversion and effectiveness of the platform. However, facilitating payments on a platform with multiple sellers is a serious challenge that will require significant amount of time, focus and that brings along risks. Furthermore, when looking at the PSD2 directive, we are preventing platforms to be supervised by the Dutch Central Bank (DNB).”

The new C2C model of Online Payment Platform provides the Dutch market with a scalable and future-resistant solution, approved by the payment association Currence. Platforms and marketplaces in the Netherlands are therefore supported by enabling to improve their service and faster growth.

.svg)

.svg)

.svg)

.svg)

.png?width=75&height=51&name=Worldline%20(2).png)